How to Save When Looking to Buy Health Insurance

Buying health insurance as an individual, family, or small business now can seem daunting at first, but it doesn’t need to be complicated. There are some certain things you want to look for when you decide to buy health insurance. Price is always a factor, and that can often be hard to gauge.

It really comes down to how much you want to pay. How much can you afford to pay each month? Like car insurance, the more money you pay monthly, the more financial coverage you’ll have should unforeseen expenses arise.

With that being said, here is some basic, but essential information you’ll want to consider when you buy health insurance:

Premium

This is the total cost of the health insurance plan you as the consumer will pay either monthly or in full. How much you pay depends on the benefits which are included in the plan. Please note: this amount is separate from the deductible.

To keep the cost low, there are some factors which you can control in order to save money. These include your deductible, copay and coinsurance amounts.

Deductible

This is the total amount which you as the consumer need to first pay toward any medical expenses you receive during your coverage period. Covered medical expenses after this amount will be paid by the health insurance company in accordance with the policy (e.g. you may still be subject to copays and coinsurance).

For example: if your deductible is $1000 and you have a $3,000 hospital bill, you would pay $1,000 and the health insurance company would pay most of the remaining $2,000 (you may be subject to coinsurance up to the policy’s max out of pocket amount). Generally speaking, the higher the deductible, the lower the premium.

Higher deductible plans are especially beneficial for those who seldom visit the doctor or purchase prescription medication. If you’re not going to use it, why pay more for it? Even with a high deductible plan, you’ll still be covered in case of an emergency. Although you will still need to pay the amount of the deductible, it’s still cheaper than the cost of most emergency procedures. High deductible plans are a great option for those who are in good health.

On the other hand, people who have a lot of medical expenses (such as surgeries) would save more money by opting for a lower deductible plan.

Copay

This is the cost which the consumer pays on top of the premium each time they go to a doctor or health specialist. Copays also apply to Emergency Room visits, urgent care visits and prescription drug purchases.

Please note: the copay (or copayments) are not applied towards your deductible, and will remain your financial responsibility even after meeting your deductible.

Your copay costs will depend on how much you pay monthly for your policy. In general, the higher the premium, the lower the copay. Conversely, lower premiums will typically have higher copays. So if you take prescription medication or require frequent doctor appointments, it would be wise to invest in a lower copay plan.

Coinsurance

This is the percentage of a medical bill that you’re responsible for paying after the insurance company pays their part. The amount that the health insurance company pays will vary based on your benefits and is only done once you have met your deductible.

Please note: coinsurance is paid on top of the copay.

The money you pay with each office visit is applied to your deductible. Once you have paid the total amount (aka meeting the deductible), you are still responsible for the coinsurance.

With a medical bill of $1,000 and deductible of $5,000, the amount you actually owe will depend on three questions:

- Have you met your deductible?

- What is your coinsurance percentage?

- What is your max out of pocket?

If you haven’t met your deductible, you’ll owe $1000 (which will be applied toward your deductible). If you have met your deductible, you’ll owe a percentage of the bill (your coinsurance). So if your coinsurance is 20%, you would pay $200 and the insurance company would pay the remaining $800.

Once you meet the max out of pocket (for example, $5,100) he health insurance company will cover the rest of your medical bills for the length of the policy. It is always wise to know exactly what services and conditions your health insurance plan covers, though, as it can vary greatly from policy to policy.

Which of these factors are most important to you in a health care policy?

Choose Wisely When you Buy Health Insurance

There’s no right plan for everyone, which is why there are many options to buy health insurance on the market. However, if you have a history of being healthy, there’s no reason to be paying the same as someone who requires more medical treatment.

Now thanks to recent changes in health care law, a healthy person could potentially save a lot of money. They can do this by purchasing an Obamacare alternative like Short Term Health Insurance.

From Obamacare to 2019: Important Health Care Reform Changes

Health insurance is changing, once again. Starting very soon (November 2018), Open Enrollment to buy health insurance will begin on the government’s official website, but this year marks a big change.

Back in 2010 when the Affordable Care Act (aka Obamacare) was passed and implemented, health insurance became mandatory for all U.S. residents. This sparked debate from Washington to Colorado to Texas to Florida and everywhere in between. Should health insurance be required? Should everyone pay the same? Should it be free?

Many healthy people applied to buy health insurance for the first time, not wanting to be subject to a hefty tax fine of $695 (or 2.5 percent of their household income, whichever was higher).

Beginning in 2019, however, the tax penalty goes away. And for those affected this year, there are many ways to get the fine waived for 2018 if you qualify.

Short Term Health Insurance = Smart Move

Short Term Health Insurance (aka short term medical insurance or STM) used to be a temporary option for people going through life-changing events such as divorce, graduation or losing a job. STM is exempt from the Affordable Care Act. It requires underwriting and it does not have to meet the minimum essential health insurance requirements. Thus, those with STM plans were subject to a tax fine. Since this will no longer apply starting in 2019, now is a great time to shop for a new STM plan. It’s likely more affordable than the ACA plans.

If any of these terms are unfamiliar, check out the Agile Health Insurance glossary for definitions.

Do you have health insurance?

If not, you need it. It’s like driving a car; you want to make sure you’re covered in case of an emergency. You never know when you will need it but you’ll be thankful later.

If you don’t have health insurance, or can’t afford it through the Affordable Care Act, now is the time to invest in a short term medical plan—especially if you’re one of the many healthy Americans with no preexisting conditions.

Not everyone is equal when it comes to health, some of us are less fortunate. If you do have pre-existing conditions or chronic illness, the ACA plans may be your best option. This is because they do not charge based on your physical condition.

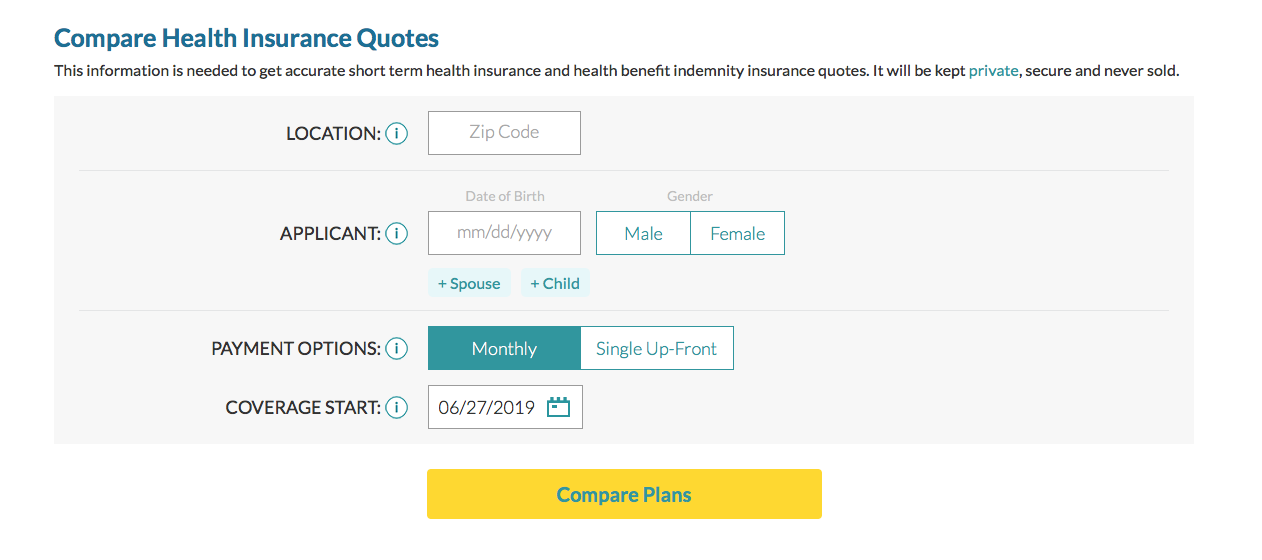

Obtain a Free Health Insurance Quote here: